Chanel Prices Are Rising Faster Than Inflation — Here’s How the Classic Flap Turned Into an Investment Bag

Chanel Prices Are Rising Faster Than Inflation — Here’s How the Classic Flap Turned Into an Investment Bag

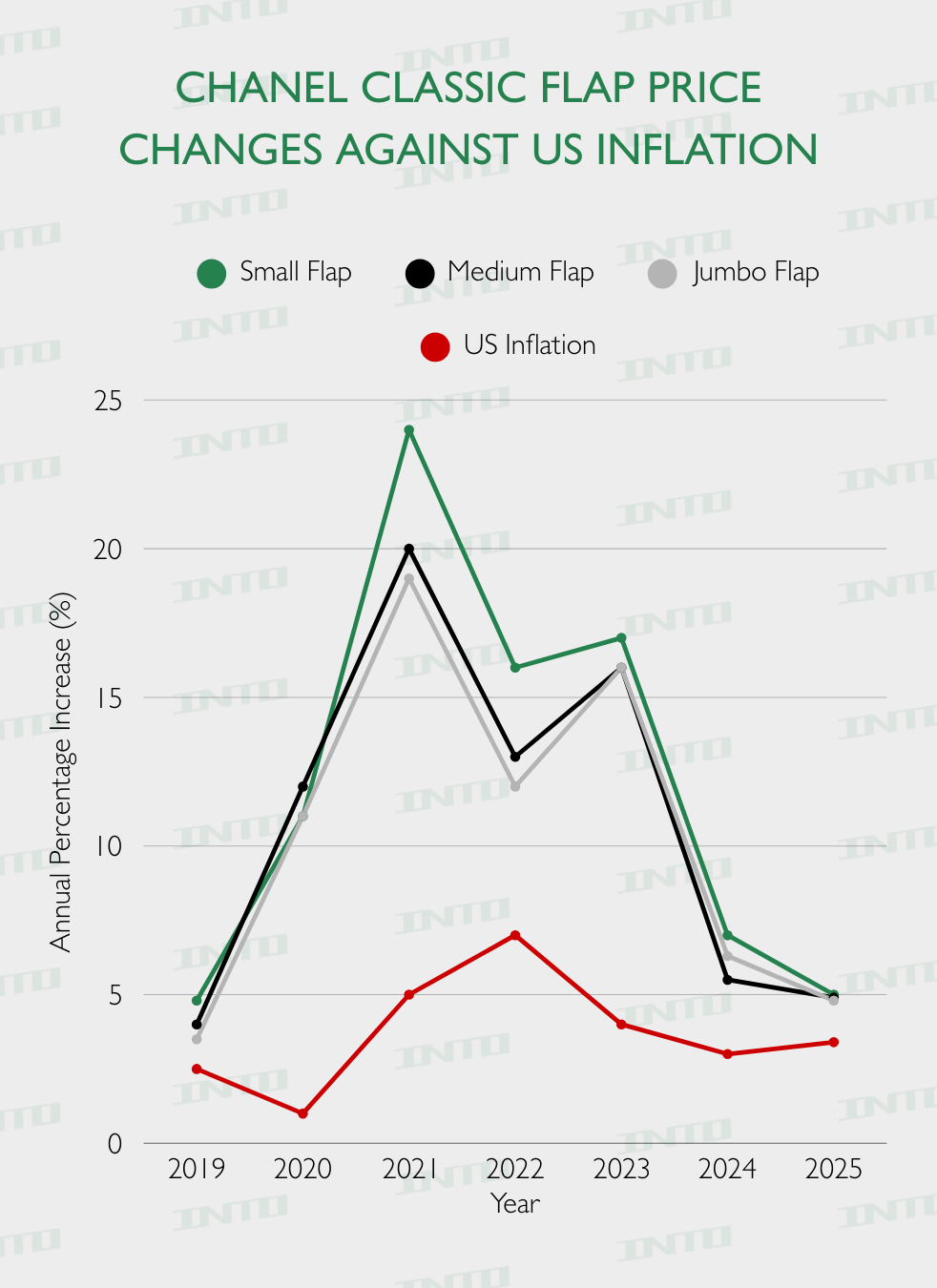

For years, fashion insiders have said the Chanel Classic Flap is “basically an asset.” Now the numbers prove it. Between 2019 and 2025, the Classic Flap — across Small, Medium, and Jumbo — has increased in price at rates up to five times higher than U.S. inflation.

This gap highlights the luxury world’s most dramatic pricing strategy shift and underscores Chanel’s efforts to cement the Classic Flap as a long-term, heirloom-level investment piece.

Chanel vs. Inflation: A Clear Pattern Emerges

From 2019 to 2025, U.S. inflation fluctuated between 1–8%. Chanel, however, consistently pushed 10–25% annual increases depending on size. The brand wasn’t reacting to inflation — it was repositioning itself.

This divergence signals a deliberate move toward ultra-luxury status, aligning Chanel more closely with Hermès in exclusivity and rarity.

2021–2022: The Years Everything Changed

The biggest jumps occurred during 2021–2022, a period that reshaped Chanel’s global identity.

- Small Classic Flap: soared above 25%

- Medium: rose past 20%

- Jumbo: climbed near 18% despite already carrying a premium price

These were not simple adjustments — they were strategic moves to elevate the Classic Flap into “investment-grade luxury.”

Why it happened:

- Increased demand post-lockdown

- Global supply chain changes

- Rising craftsmanship and material costs

- A strategic branding shift toward exclusivity

- Scarcity-driven pricing across luxury markets

2023–2025: Softer Increases, But Still Higher Than Inflation

While inflation cooled to 2–4% in the mid-2020s, Chanel maintained 5–8% increases. This “slower” growth still positioned Chanel well above inflation and allowed the brand to stabilize after steep earlier hikes.

Even during calmer years, the Classic Flap was consistently outperforming standard economic trends — reinforcing its status as a high-value asset.

Why Chanel Can Get Away With These Price Hikes

Several long-term forces fuel Chanel’s unique pricing power:

- Heritage & desirability: The Classic Flap is one of the most recognized luxury items in the world.

- Resale value: Preowned prices remain high, reinforcing investment behavior.

- Controlled supply: Fewer bags + higher demand = elevated pricing power.

- Global luxury growth: The U.S., China, and the Middle East continue driving demand.

- Brand elevation: Chanel is actively positioning itself in Hermès territory.

What This Means for Shoppers

- New buyers face higher entry barriers, making the bag even more exclusive.

- Existing owners benefit from appreciation, often seeing strong resale values.

- And for collectors? The Classic Flap remains one of the most inflation-resistant luxury buys on the market.

The Bottom Line

Chanel isn’t just raising prices — it’s redefining what luxury costs. Between 2019 and 2025, the Classic Flap proved itself not just as a fashion icon, but as a financial asset that operates independently of the general economy.